News

Louis Dor

Jun 29, 2016

Picture: Christopher Furlong/Getty Images

As Brexit sets in, and we see the full economic consequences of voting Leave, some have been better off than others.

Guess what? It's not the "decent", "ordinary" people Nigel Farage described in his victory speech:

This will be a victory for real people, a victory for ordinary people, a victory for decent people.

With a new recession looming and more cuts and tax rises threatened by George Osborne, here's a run through of some of those who have actually benefited so far:

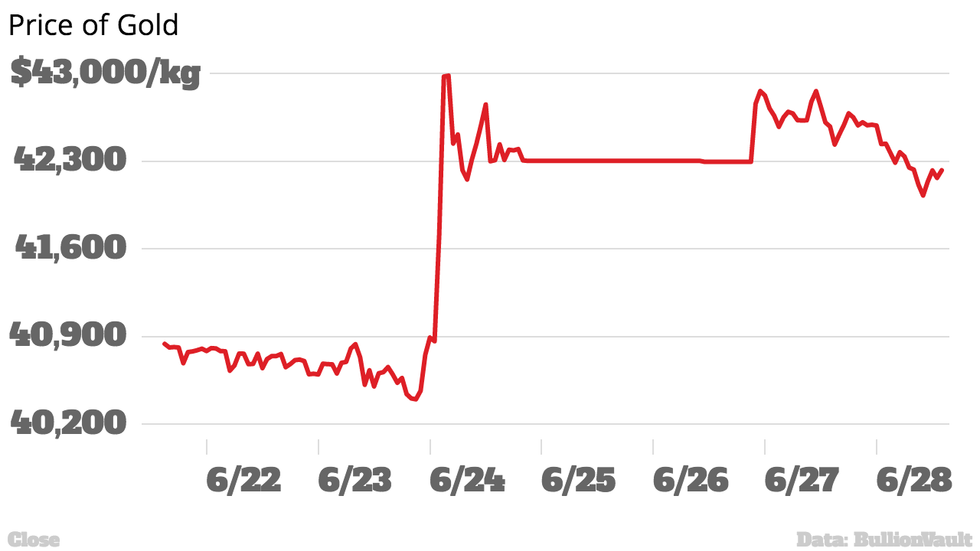

Gold traders

Look what happened to its price when Brexit occurred.

Gold miners have now found that every ounce they produce is roughly six per cent more valuable.

This is because in economic crisis times, gold is seen as a safe asset.

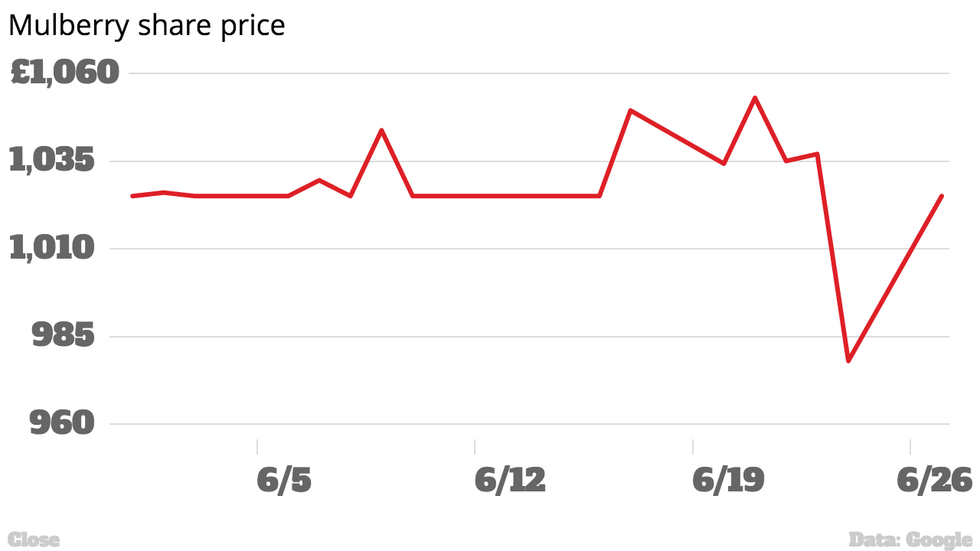

Luxury brands

The weakness of the pound has made it far cheaper for other countries to buy British - so brands like Mulberry have seen a swift recovery against the market.

We won't see the full effects until financial results are published later in the year.

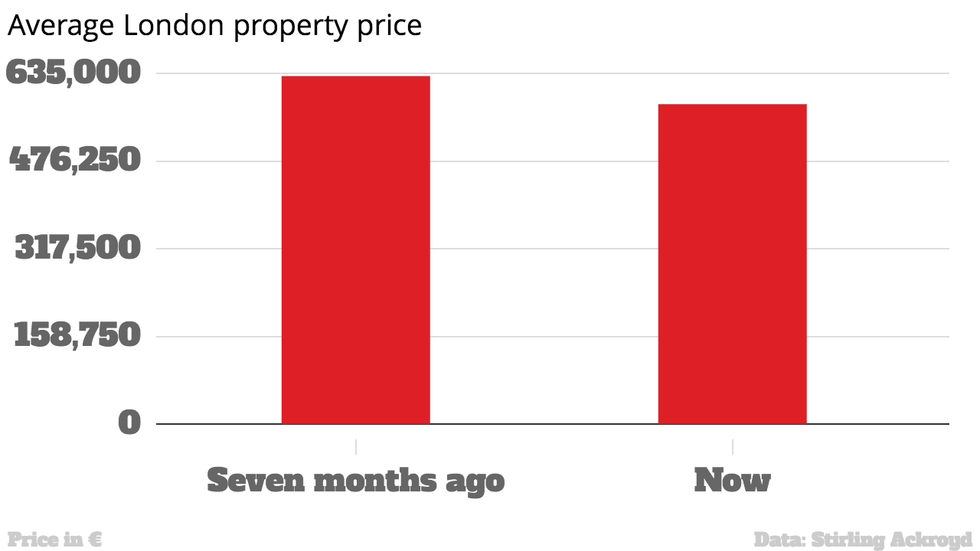

Foreign property buyers

Estate agency Stirling Ackroyd said in a statement released on Friday that overseas buyers are saving more than £40,000 on London property prices following Brexit.

After the pound slumped seven per cent against the euro, the estate agents said the effective price cut for eurozone buyers in London had reached eight per cent.

Managing director Andrew Bridges said in a statement:

Overnight, London has become a more affordable global property hotspot, particularly for those paying in euros.

Hedge fund managers, multinationals and pharmaceuticals

Pharmaceuticals are doing well because they're a safe stock - people always need medicine.

Meanwhile, hedge fund managers may have won or lost by taking multimillion pound bets on the vote in one form or another.

As the Guardian reported, billionaires Crispin Odey and Sir Michael Hintze are known to have publicly backed Brexit.

Multinationals will also have gained if they earn more money in dollars or euros than pounds. Unilever saw a 4.5 per cent rise following Brexit, while GlaxoSmithKline rose by 5 per cent.

More: 8 of the most misleading promises of the Vote Leave campaign, ranked in order of preposterousness

More: The Sun has also got around to telling its readers what Brexit will mean, and they are not happy

Top 100

The Conversation (0)