News

The deficit-reduction challenge facing the next government will become clearer today.

Ministers are anxiously awaiting the Office for Budgetary Responsibility’s verdict on whether a “tax gap” estimated at £17bn of falling income tax revenues is a temporary blip or permanent change which could mean even deeper spending cuts in the 2015-20 parliament. Ministers hope the explanation is a “time lag” and that tax receipts will recover.

The issue is politically sensitive because the shortfall stems partly from the Coalition’s decisions to raise the personal tax allowance to £10,500 by next April and to cut the 50p top rate on earnings over £150,000 to 45p, which persuaded high earners to defer bonuses to keep down their tax bills. Tax revenues have also been hit by the creation of many low paid and part-time jobs; wages rising more slowly than inflation and people becoming self-employed.

In March, the OBR forecast income tax receipts in the current financial year at £166.5bn. But the IPPR think-tank estimates an £8bn shortfall.

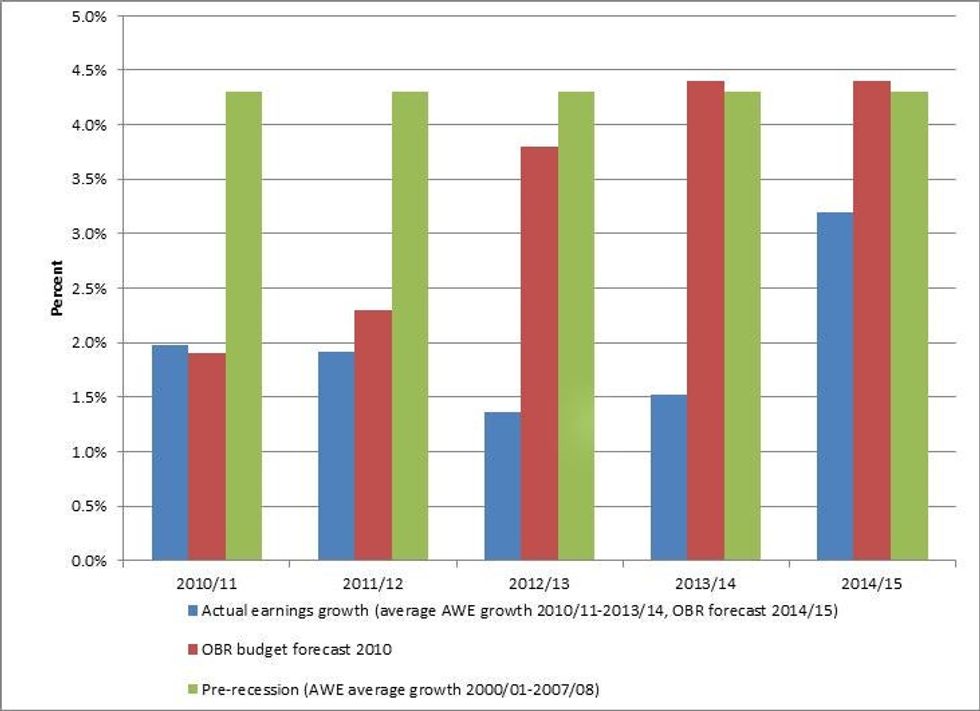

Actual earnings growth vs the OBR’s predictions of earnings growth

According to the TUC, if earnings growth between 2010/11 and 2014/15 had been in line with the OBR’s forecast during the June 2010 Budget, the Treasury would have made £175.6bn in income tax receipts in 2014/15 - £17.1bn higher than the estimated figure.

More: What to expect from George Osborne todayMore: Six ways Osborne is going to try to trick you in his Autumn Statement

Top 100

The Conversation (0)