News

Hamish McRae (edited

Sep 24, 2014

There is a lot of momentum behind the present growth spurt, but common sense says that momentum is likely to ease over two or three years.

The house price boom really cannot continue and interest rates will inevitably rise. How far they will go up – whether to 2 or 3 per cent or 4 or 5 per cent – I don’t think we can possibly say.

The Bank of England is keen to push the idea that rates will not rise quickly, but central banks are not gods. No-one, as far as I know, in the European Central Bank three years ago saw the possibility of it having negative rates.

So, for the UK, there is likely to be reasonable growth over the next few years, strong for another year or two but probably tapering down after that. That quite benign prospect does, however, depend on a favourable global cycle.

The cycle, ah. If would be great if we understood it properly but we don’t. The very latest data does seem to show that for the UK at least, the 2008/9 downturn was no more serious than the early 1980s one if you allow for the fact that North Sea oil was growing in the 1980s and falling now.

But the early 1980s were not great either, and for the developed world as a whole this most recent recession was indeed the worst since the Second World War.

That all leads to a hopeful conclusion. These huge recessions don’t come along very often and accordingly it is improbable that we will experience anything like 2008/9 for a generation. The less hopeful conclusion, looking at past patterns, is that some sort of downturn is likely to occur during the life of the next Parliament.

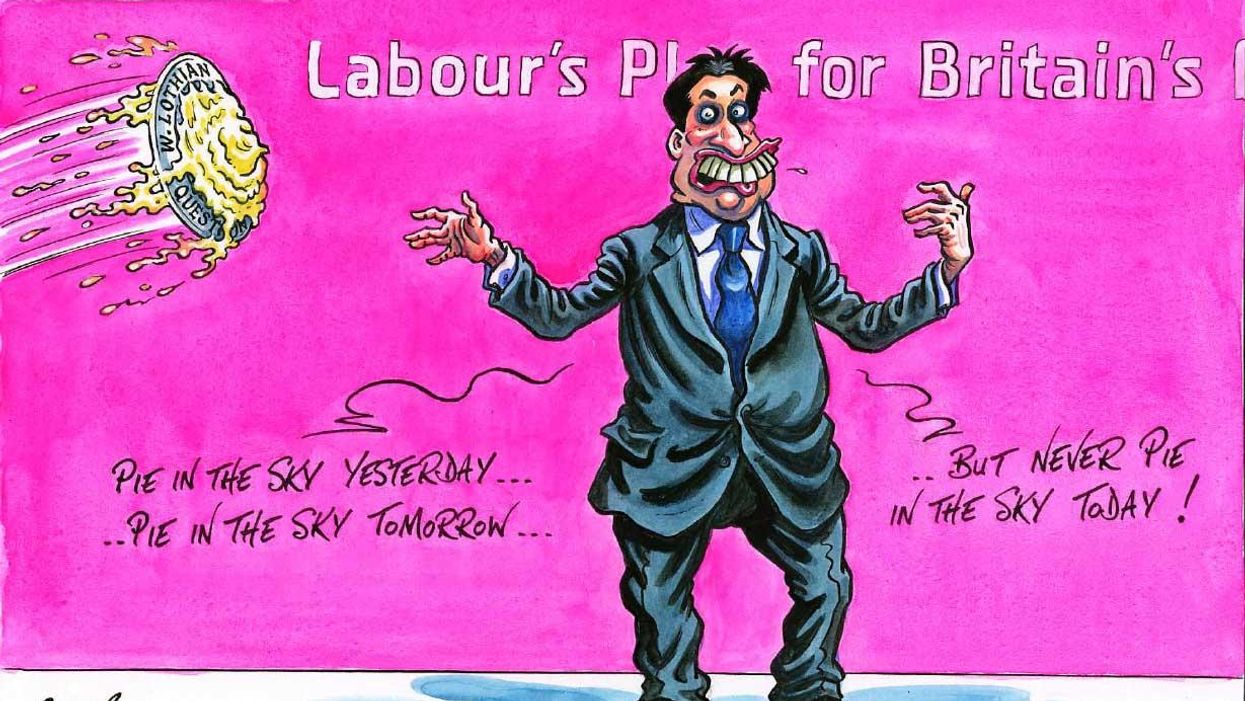

More: What Ed Miliband forgot to sayMore: Meanwhile, George Osborne..

Top 100

The Conversation (0)