News

Louis Dor

Mar 10, 2016

Picture: Christopher Furlong/Getty Images

If you're young and think you're going to buy a house any time soon, think again, because rising house and deposit prices are going nowhere.

A new report by the Centre for Economics and Business Research for financial comparison website money.co.uk, has found that deposits are predicted to rise by 40 per cent by 2026.

In some regions, this will take up to 120 per cent of the average monthly salary, and is double the predicted increase to monthly salaries - meaning it's only going to take longer to save for a deposit in future.

The average deposit is projected by the report to be £1,111 in 2026, 70 per cent of the average monthly income of £1,576.

In London, deposits are projected to rise to £2,733, taking up 120 per cent of one month’s average salary at £2,281.

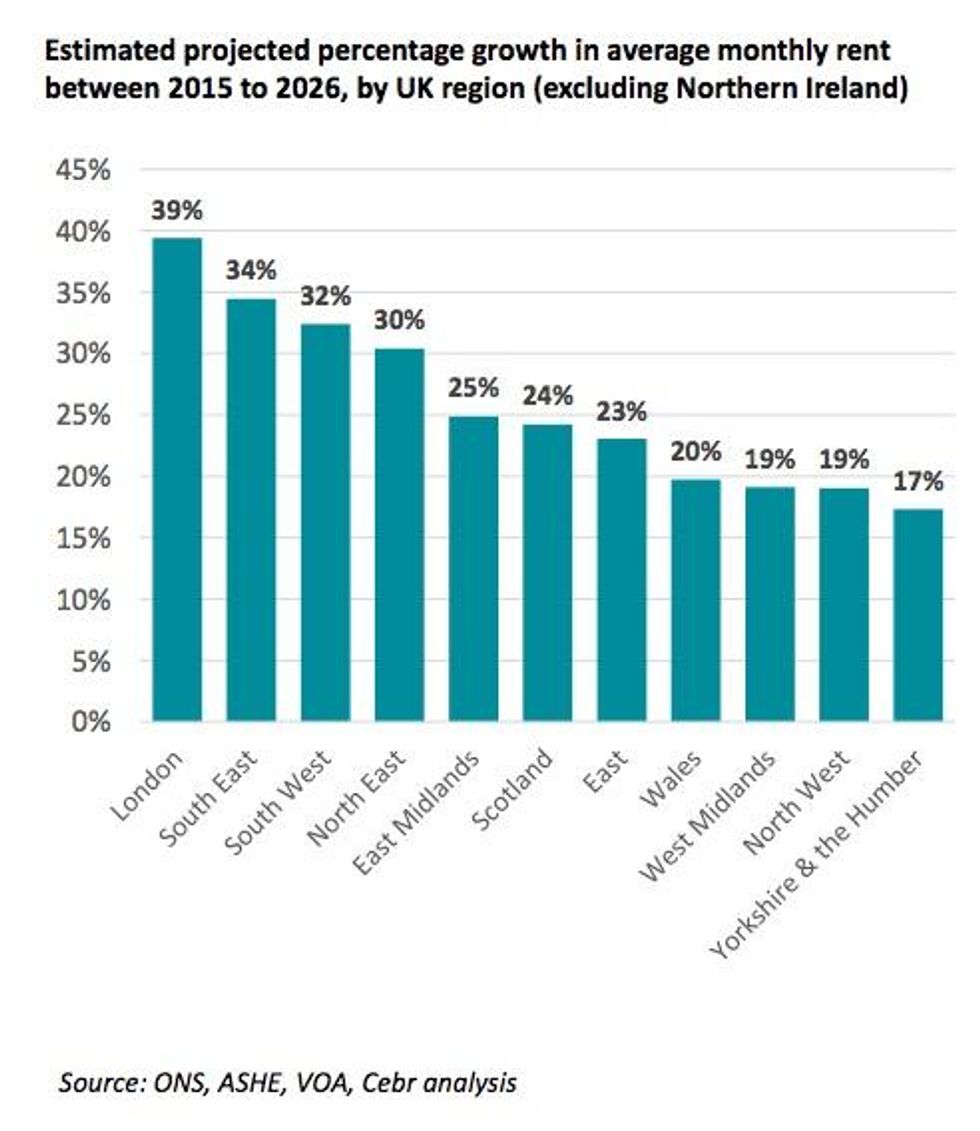

The report also says monthly rental costs are set to rise by 28 per cent to £1,111 in ten years time.

Rental inflation is also estimated to outstrip monthly salaries across the UK - making it harder to pay the rent.

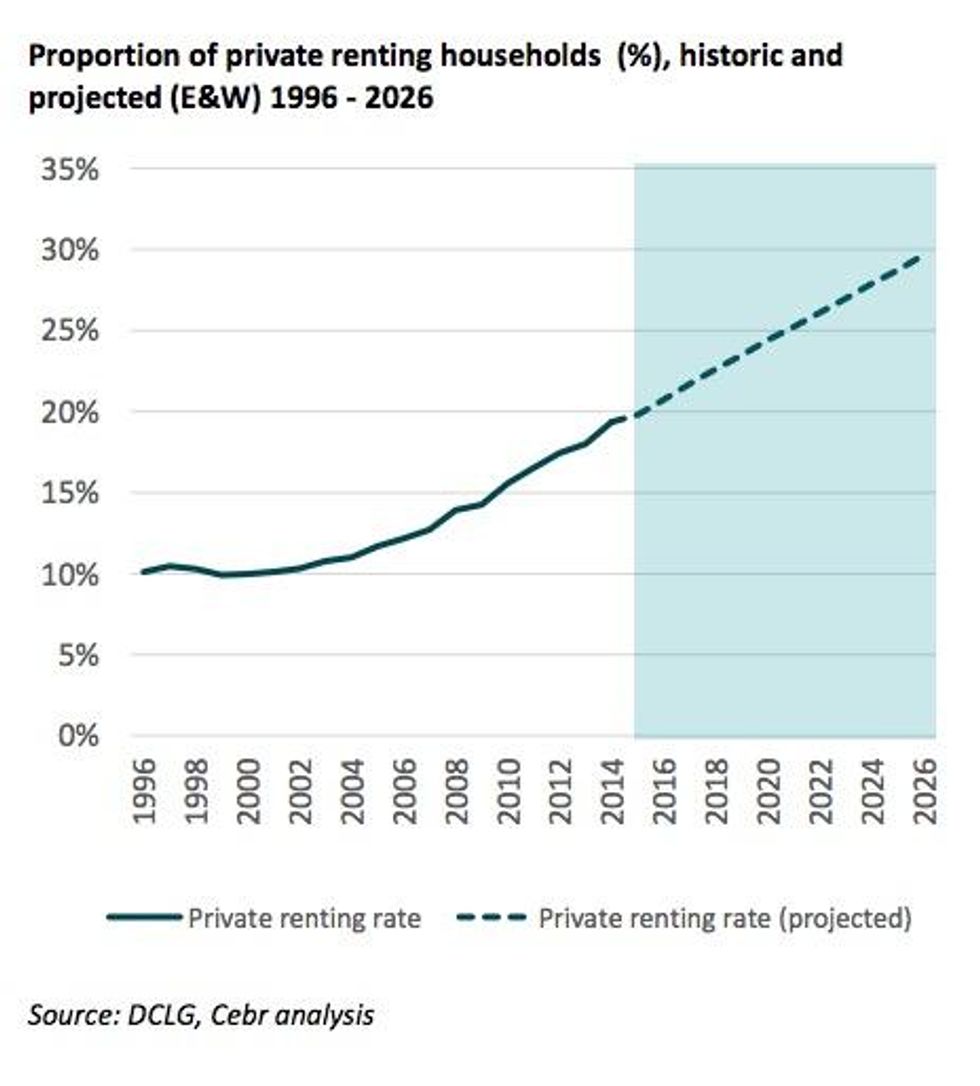

By 2026, 7.2 million households in England and Wales are estimated to be privately rented by the report - two thirds more than were in 2014.

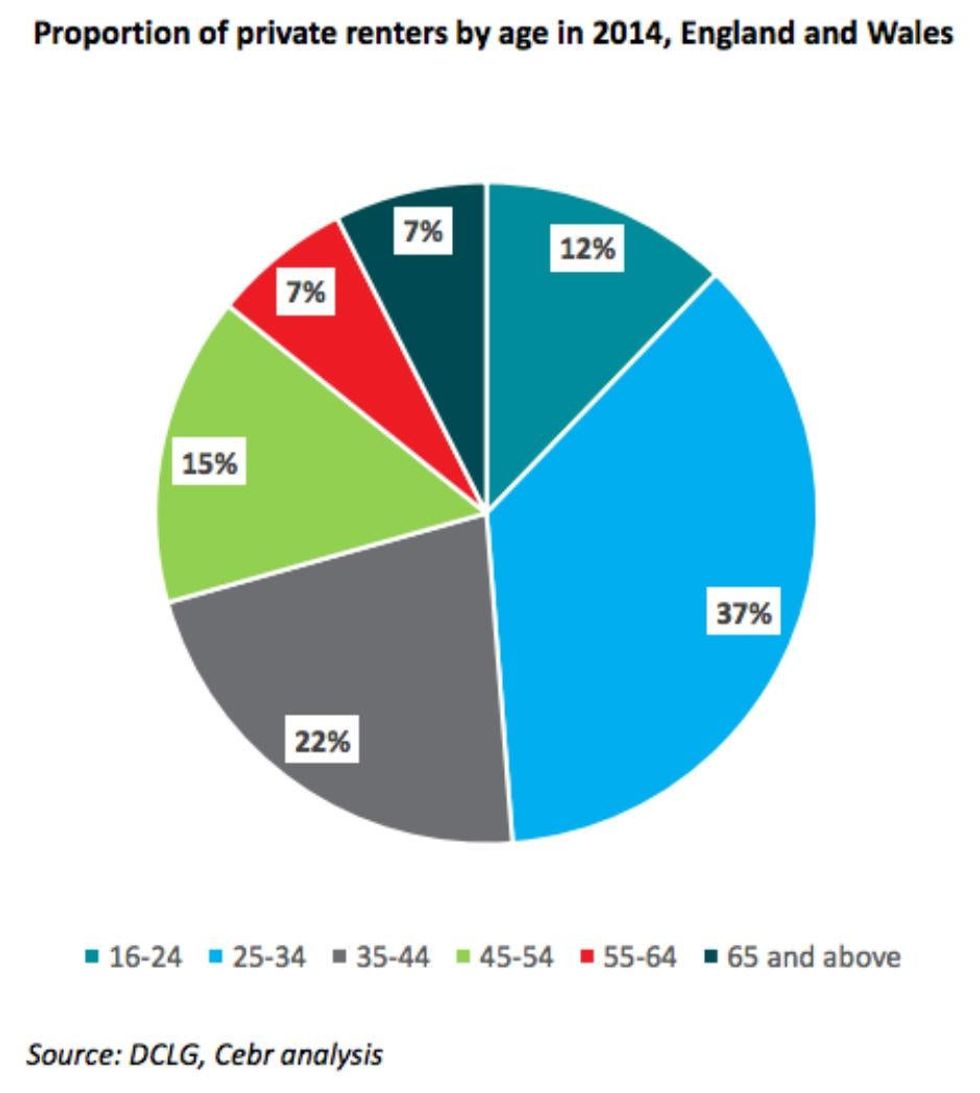

And if you're wondering how all this affects young people in particular, this chart should explain it...

More: The average price of a London house is now half a million pounds

More: How house prices have skyrocketed in the last twenty years

More: These posters are a reminder of the crisis politicians can't ignore

Top 100

The Conversation (0)