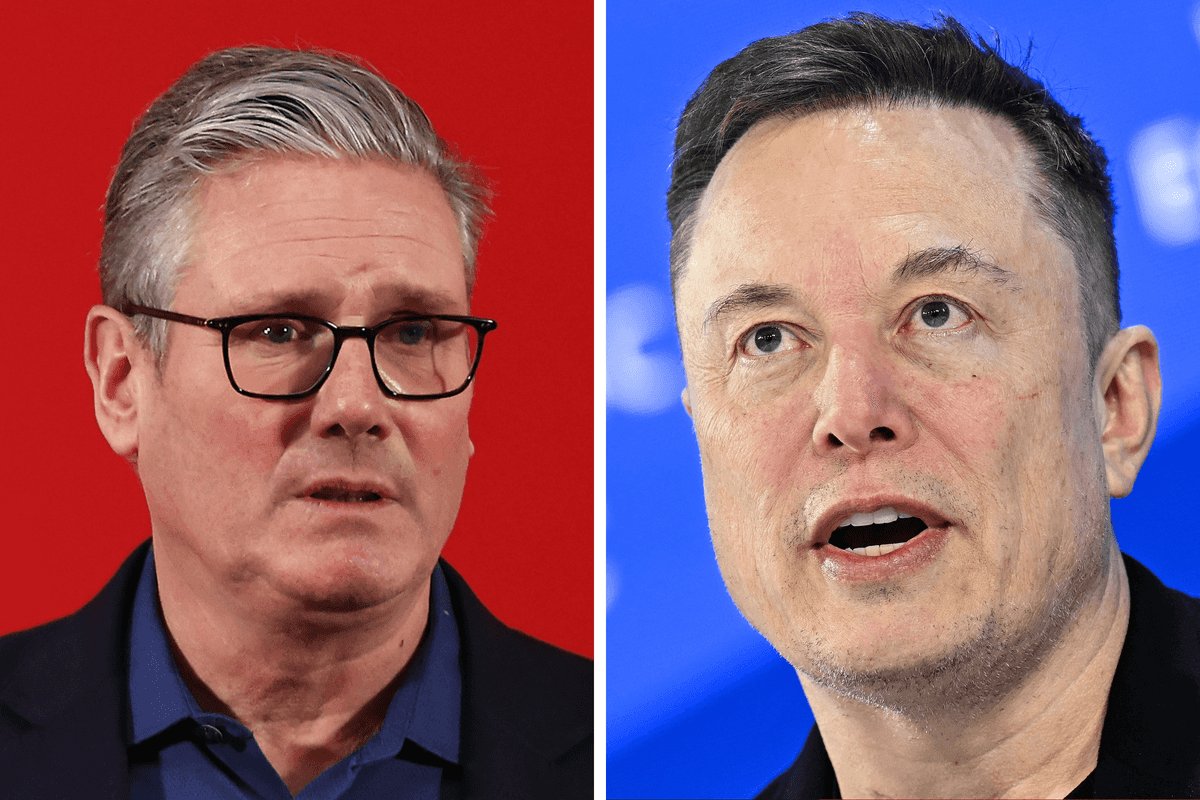

On Tuesday, Tesla stock fell by 12.2 percent, causing the company to lose more than $125 billion in market value following news that Tesla CEO Elon Musk had purchased Twitter for $44 billion.

Following the announcement, the stock fell price fell as it was reported Musk has secured a loan for $12.5 billion against his 17 percent stake in Tesla.

Some reports have said investors may also be concerned that Musk would divert his attention from the company to focus on his new venture and sell some of his shares in order to fund his new investment.

Musk made a bid for the social media platform weeks ago but Twitter did not seem to seriously consider the bid until last Thursday when Musk filed an SEC filing indicating how he planned to fund his bid.

In the filing, Musk said he planned to use $21 billion of his money with the other half funded by other financial institutions.

Sign up for our new free Indy100 weekly newsletter

Musk is the richest person in the world with an estimated net worth of $239.2 billion according to Forbes. Most of Musk's wealth is attributed to his Tesla stock.

Back in November, Musk sold off 10 percent of that Tesla stock, causing the share price to fall 26 percent. But it made a comeback in December as Musk announced he was "almost done" with his sales.

But Tuesday's drop is the largest the Tesla stock has endured in one day.

Tesla told investors back in February that "we are highly dependent on the services of Elon Musk" and "If Elon Musk were forced to sell shares of our common stock that he has pledged to secure certain personal loan obligations, such sales could cause our stock price to decline."

Have your say in our news democracy. Click the upvote icon at the top of the page to help raise this article through the indy100 rankings.