News

Narjas T. Zatat

Mar 10, 2016

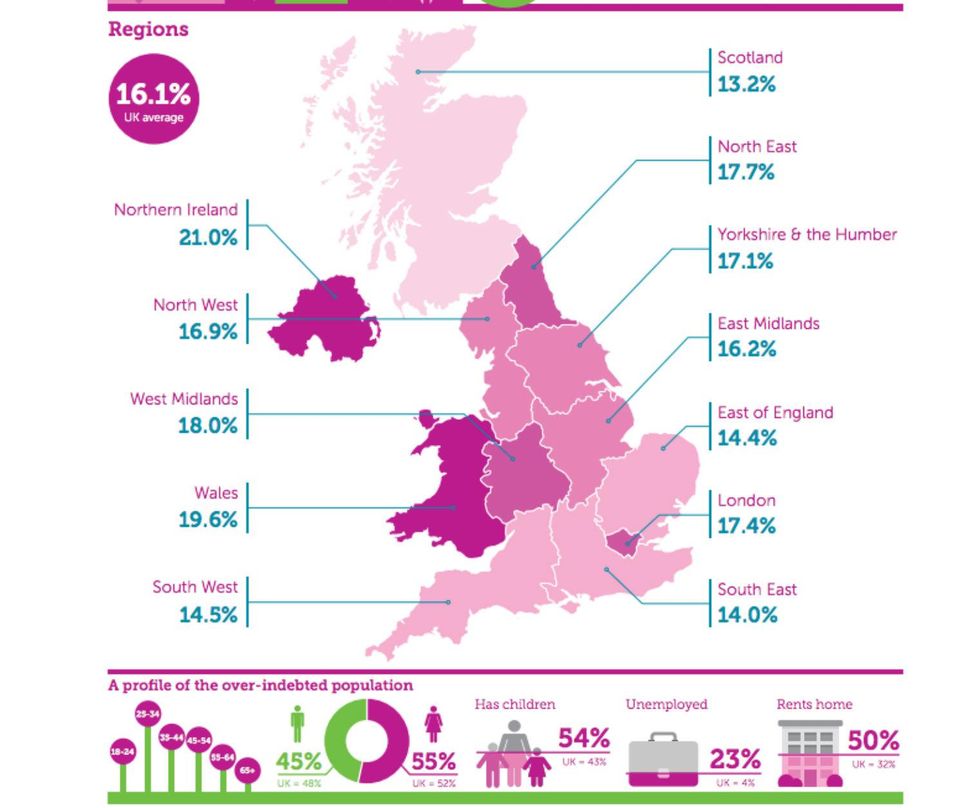

The Money Advice Service collaborated with CACI to write a report, compiling a list of local authorities in the UK with the highest and lowest "over-indebtedness".

What is the definition of over-indebtedness? Respondents were instructed to answer 'yes' or 'no' to the following two questions:

Do you find keeping up with bills and credit commitments a heavy burden?

And:

Have you fallen behind or missed payments in at least three of the last six months?

According to the research, the national average is 16.1 per cent:

Here are the 10 most over-indebted areas:

1. Sandwell, West Midlands (24.7%)

2. Blaenau Gwent, Wales (24.3%)

3. Merthyr Tydfil, Wales (24.1)

4. Newham, London (23.8%)

5. Derry and Strabane, Northern Ireland (23.8%)

6. Barking and Dagenham, London (23.0%)

7. Belfast, Northern Ireland (22.9%)

8. Tower Hamlets, London (22.9%)

9. Kingston upon Hull, Yorkshire and The Humber (21.9%)

10. Rhondda Cynon Taf, Wales (21.9%)

Most of the local authorities who fall below the UK average are located in the South west.

Here are the 10 least over-indebted areas:

1. East Renfrewshire, Scotland, (10.0%)

2. East Dorset, South West (10.1%)

3. East Dunbartonshire, Scotland (10.1%)

4. Elmbridge, South East (10.2%)

5. Mole Valley, South East (10.3%)

6. South Bucks, South East (10.6%)

7. Chiltern, South East (10.6%)

8. Epsom and Ewell, South East (10.6)

9. Aberdeenshire, Scotland (10.7%)

10. Hart, South East (10.7%)

The over-indebtedness population is younger, more likely to rent and more likely to have children than the UK as a whole.

Of the top ten most indebted areas, London features three times - Newham, Barking and Dagenham, and Tower Hamlets.

These boroughs are also amongst the most deprived areas of the UK, which seems to indicate a correlation between local authority areas that are heavily in debt, and poverty.

More: A map showing the debt of countries around the world according to their GDP

More: This city is home to all of the UK's top tourist attractions

Top 100

The Conversation (0)