News

Evan Bartlett

Jan 26, 2015

The left-wing Syriza party has won the Greek election after riding a wave of anti-austerity sentiment in the country.

Alexis Tsipras, the party's leader, promises radical reforms and says he wants to re-negotiate the country’s €240bn debt.

Here are seven charts that put the win into context...

1. Make-up of parliament

Syriza won 149 seats in the Greek parliament - agonisingly short of the 151 they needed for an outright majority.

As a result they have struck a deal with the right-of-centre Independent Greeks who, while disagreeing on many social policies, agree with their desire to stop austerity.

The neo-Nazi party Golden Dawn, with 17 seats, become the third largest party in Greek parliament.

2. Sovereign debt

This chart from Eurostat shows that sovereign debt as a percentage of GDP is higher in Greece than any other country in the EU.

One of Syriza's key policies is to renegotiate the repayment deal with the country's lenders - the EU, International Monetary Fund and European Central Bank - to end austerity measures that came as part of the lending deal that has crippled the economy.

3. Shrinking GDP

While countries such as France and Italy have a far higher overall debt, Greece's debt to GDP is so much higher because the economy has stagnated as this chart, being shared widely on Twitter today, shows.

4. Unemployment rate

After living way beyond its means for years, Greece suffered badly after the global financial crisis in 2008. Jobs dried up and unemployment soared, as this chart from Trading Economics shows.

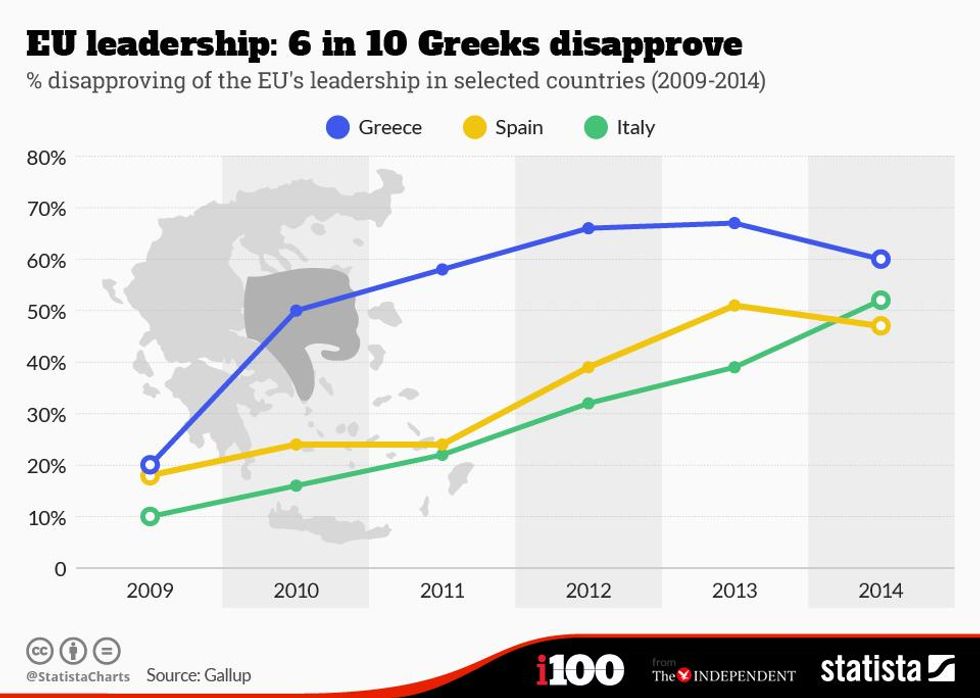

5. Disapproval of the EU

As a result of the huge debt burden and the stagnating economy, discontent has risen in Greece and, as this chart from Statista shows, six in 10 Greeks disapprove of the EU leadership - along with Spain and Italy who have similarly ailing economies.

6. Majority want to keep the Euro

Despite all this bad feeling, recent opinion polls have shown that 75 per cent of Greeks want to keep the Euro, with a return to the drachma being seen as potentially dangerous.

7. Widespread consequences

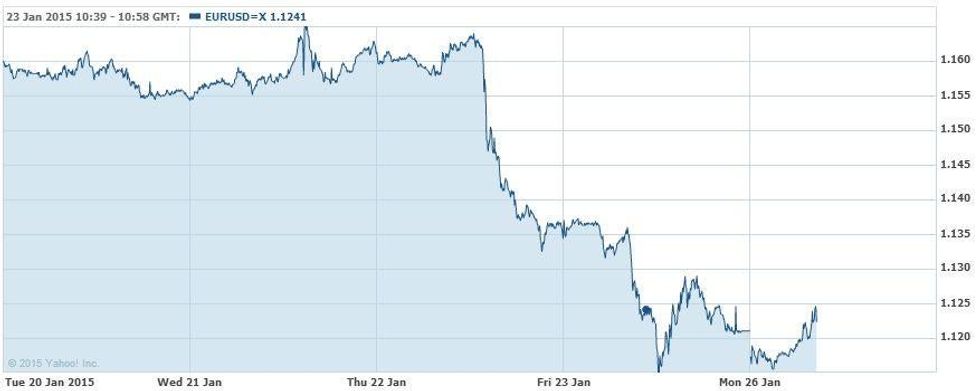

Nevertheless, victory for what many international observers see as a radical left-wing party and fears of a looming stand-off with the EU has seen the price of the Euro fall to an 11-year low against the dollar at $1.1088, as this chart from Yahoo shows.

The Independent's economics editor Ben Chu suggests: "There is a possibility a Grexit (Greek exit) could reopen the continent’s financial crisis if it prompted panicking people and companies to yank money out of perceived vulnerable European countries’ banks again." A shaky future lies ahead for the Euro - at least in the short-term.

Top 100

The Conversation (0)

x