News

Joe Vesey-Byrne

Apr 04, 2017

Picture:

BEN PRUCHNIE/GETTY IMAGES

The uncomfortable truth in politics is that the rewards of a good headline can come instantly.

Good coverage of an on-brand policy announcement can be reaped within hours thanks to online journalism.

The actual bite of a political decision won't come for possibly years afterwards.

For example; five cuts to spending which will come into force this week were actually announced years ago.

And that is a long time, when you think about the fact that twelve months ago David Cameron was still prime minister, Britain was still a member of the European Union, and Jeremy Corbyn had only faced off multiple rounds of shadow cabinet resignations and six soft coups.

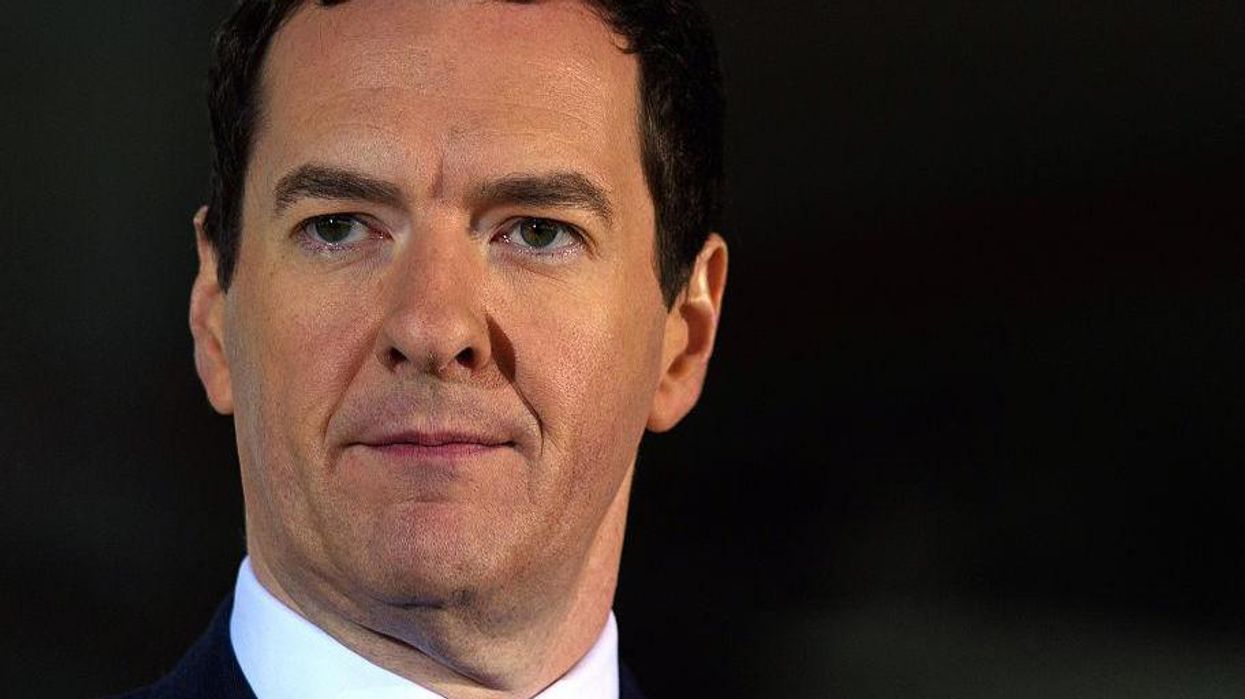

The majority of the cuts that could affect you by Thursday were announced by George Osborne in his time as chancellor of the exchequer and Iain Duncan-Smith who was once the work and pensions secretary.

The changes affecting low income families, disabled people, young homeless people, and widows and widowers were all announced in the Summer Budget 2015, just weeks after the Conservative election victory.

According to the Resolution foundation, the majority of tax giveaways in the next year will go to households from the better-off half, while the poorest third will shoulder most of the cuts to benefits.

It should be noted that those in the other two thirds of households, are less likely to need welfare or state benefits, due to the fact they are less poor than the bottom third.

So how many people will be poorer at the end of the week than they when started it?

515,000 families with more than 2 children

From Thursday the Child Tax Credit (CTC), will only be paid for first two children born in any family. The credit was worth up to £2,780 per child per year.

The CTC exists to help families who have a combined household income below a set amount by funding some of the cost of childcare.

Any third child born after 6 April 2017 will not be eligible for the credit.

Families with three or more children who currently receive the credit will still be eligible, unless they stop claiming CTC for six months or longer.

If they do pause claiming, when they go back onto CTC the family will be subject to the limit and will therefore be worse off.

It is thought 515,000 families will be affected by 2020.

More distressingly, women whose third child was conceived when a man raped her, will have to prove the rape in order to get an exception to the two child limit.

Other exceptions exist for twins and triplets born to families who already had one child, adopted children (except those adopted by a step-parent), children with a disability, and children looked after by a friend or family carer.

The changes to the limit on children were announced in the 2015 Summer Budget, which was opposed by the Labour Party.

The cuts, including this one, were actually implemented as part of the 2016 Welfare Reform and Work Bill, which 184 Labour MPs allowed to pass by not voting against it.

48 MPs including the Labour leader Jeremy Corbyn rebelled and voted against giving the bill a second reading in July 2015.

The interim leader at the time Harriet Harman whipped Labour MPs to abstain.

The result would not have changed even if all 232 Labour MPs had voted against the bill instead of abstaining, given that presumably the 22 Conservative abstentions would not have been allowed by Tory Whips.

970,00 families on low incomes

The government will end the 'Family element', a minimum payment of £545 once a year that was paid to all families claiming the Child Tax Credit.

The move will be a cut of £540 million a year by 2020.

Estimates show 970,000 families receiving CTC and the 'family element' payment will be affected by the change.

It will apply to all new applicants to claim CTC from Thursday.

The announcement was made in George Osborne's 2015 Summer Budget.

500,000 disabled people

Disabled people who currently receive Employment and Support Allowance will be docked £29.05 less every week by being deemed fit for 'work-related activity'.

The department for work and pensions has given 'work-related activity group' the horrible acronym Wrag.

The change will mean that disabled people designated as such will receive the same benefits as people receiving job seekers' allowance.

Anyone claiming ESA from Monday could have the cut applied to them, and anybody who starts to claim ESA again after a 12 week break.

The announcement was made in George Osborne's 2015 Summer Budget.

11,000 young homeless people

Jobseekers aged 18-21 will no longer be eligible for housing benefit which were previously given directly to landlords.

This change came into effect on 1 April and applies to new claimants with some exceptions.

The cut is worth £105 million by 2020.

Exceptions to the cut include:

- Young people earning at least £89.60 a week

- Young people with children

- Young people living in temporary accommodation for the homeless

- Victims of domestic violence or threats of domestic violence

- Orphans and care leavers

- Young people whose parents live abroad

Other exemptions apply for people receiving disability benefits, and those for whom it would 'inappropriate' to live at home.

According to the Mirror, charities have pointed out how difficult to prove this last measure will be.

The announcement was made in George Osborne's 2015 Summer Budget.

An unlimited amount of Widows and Widowers

Although this figure can't be nailed down, it could be in the tens of thousands.

From Thursday, in a move designed to save over £100 million a year in the long term, all bereavement benefits are being replaced with one Bereavement Support Payment.

Under this scheme, 48 per cent of claimants will be worse off.

The new BSP will be worth £3,500 and £350 a month for 18 months for claimants with dependent children.

The announcement was made in George Osborne's 2015 Summer Budget.

Millions aged 16-64 of people receiving working age benefits

A freeze of all working age benefits will take place for four years.

The effective cut when inflation is considered, is designed to save the Treasury £3.5 billion.

The only direct recipients of benefits who won't be affected by this change are pensioners.

HT Mirror

More: Tory MP calls Britain's pink passports 'humiliating'. They're burgundy.

Top 100

The Conversation (0)