Liam O'Dell

Jan 20, 2023

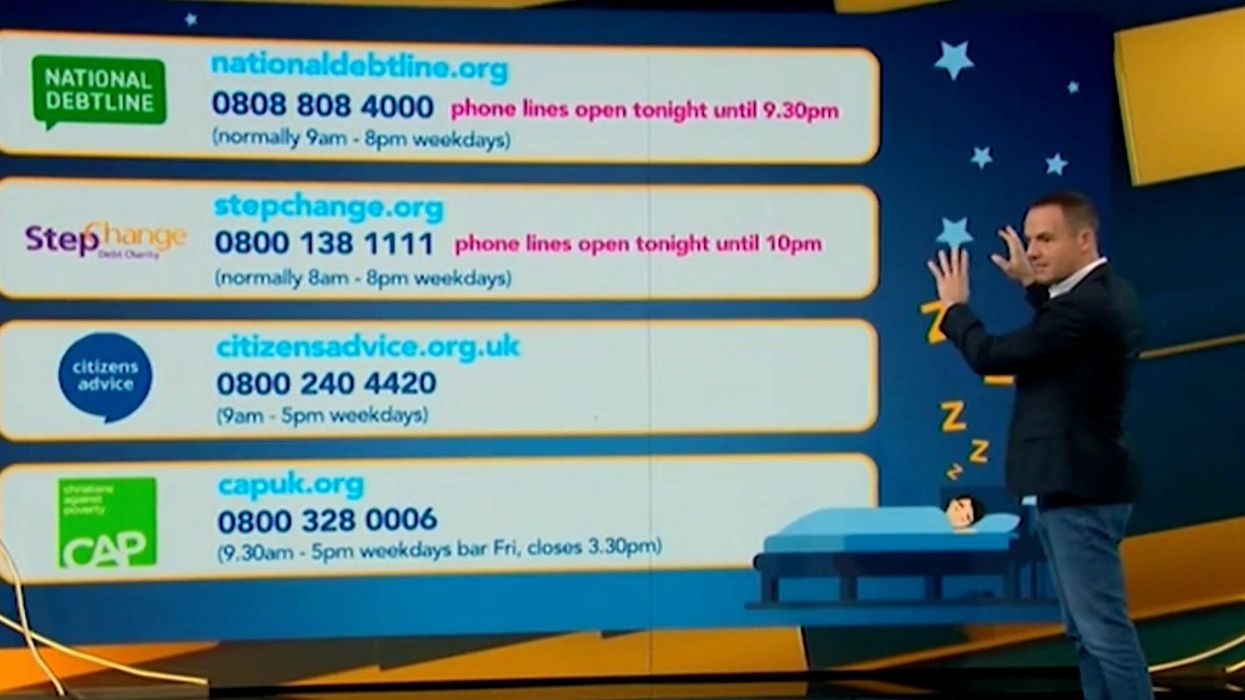

Related video: Martin Lewis reveals which charity can help people struggling with debt

The Martin Lewis Money Show Live, ITV

Money-saving expert and campaigner Martin Lewis has been a reassuring voice and all-round Good Egg amid the ongoing cost-of-living crisis, but on top of being incredibly serious when it comes to the challenges we’re all facing, Tuesday’s episode of The Martin Lewis Money Show proved he also has a sense of humour.

During the show – which was themed around cutting the cost of debts – Lewis turned to credit cards and how a zero per cent balance transfer card (that is, one where you can transfer money over to pay a debt on another credit card, with no interest charged for a set period).

Essentially, the card is about clearing debts through a method known as “snowballing”, with Lewis advising against spending on a zero per cent card.

He told viewers: “Clear your debts in highest interest order first, which for many will be the overdraft.

“Then you take all the spare cash you possibly have and you put it at clearing the highest interest rate debts. You only pay the minimum on the others.

“Then when the top one goes, you focus on clearing the next highest and so on.”

Sign up to our free Indy100 weekly newsletter

The advisor continued to say individuals should use savings to clear debts, with the benefit that they can be transferred back onto the card afterwards without losing anything.

He also said people should set up a direct debit to pay back “at least the minimum” on the card, and that the card should be cleared before the zero per cent period ends to avoid paying the 20-22 per cent rate – with a balance transfer being a way to handle it if you can’t.

“If you’re struggling, tell people you’re in debt, tell people you can’t afford to buy a round. And everyone else: let’s not put pressure on people to spend when they don’t have the cash.

OK, so aside from the “snowballing” thing, where does freezing and water bowls come into this?

Well, Lewis went on to stress: “These cards are only for shifting debt to, and if you really don’t trust yourself, get the card [and] get a bowl of water.

“Card in the water, bowl in the fridge [he meant freezer], then you’ll need a hammer to spend on the card and it might give you a moment of thinking time.”

We imagine this method would be quite a cool (sorry) method to stop impulse spending in general, to be honest.

Have your say in our news democracy. Click the upvote icon at the top of the page to help raise this article through the indy100 rankings.

Top 100

The Conversation (0)