News

Bethan McKernan

Jun 27, 2015

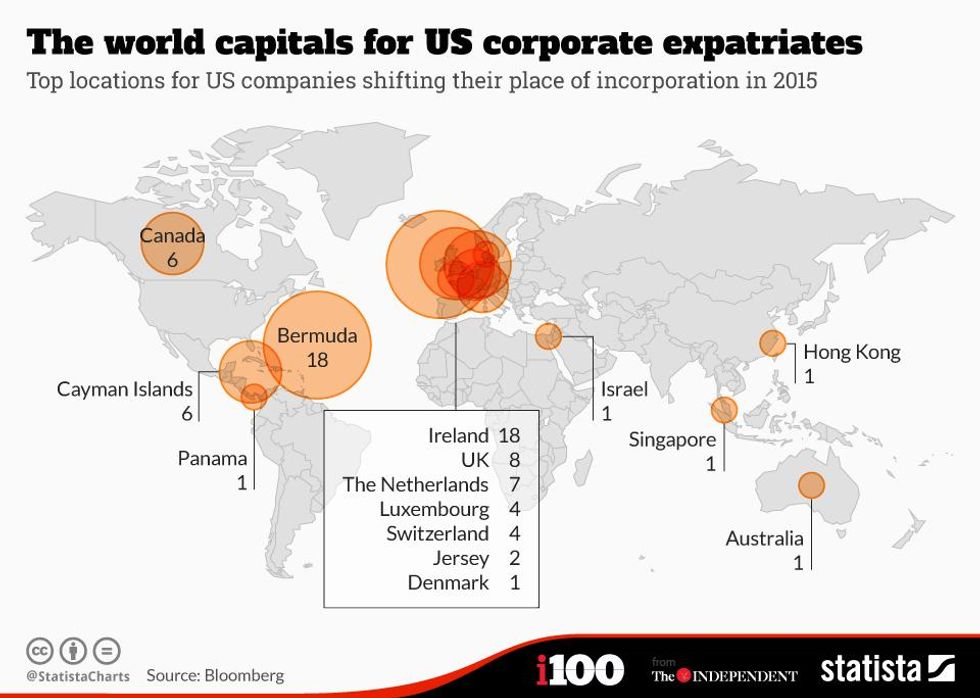

It's probably not a surprise that American companies that up and move their headquarters to become incorporated somewhere else usually go for countries with low or even no corporate income taxes.

New data from Bloomberg shows that while Bermuda used to be the destination of choice a decade ago, now the clear frontrunner is Ireland, where income for companies is taxed at just 12.5 per cent - compared to 21 per cent in the UK and a top rate of 35 per cent for companies with the biggest profits in the US.

Pharmaceutical giants, tech companies and management consultancy firms have all upped sticks from the US for Dublin in search of more pots of gold, as this Statista infographic shows.

More: We went on a tax avoidance tour through the heart of London

Top 100

The Conversation (0)